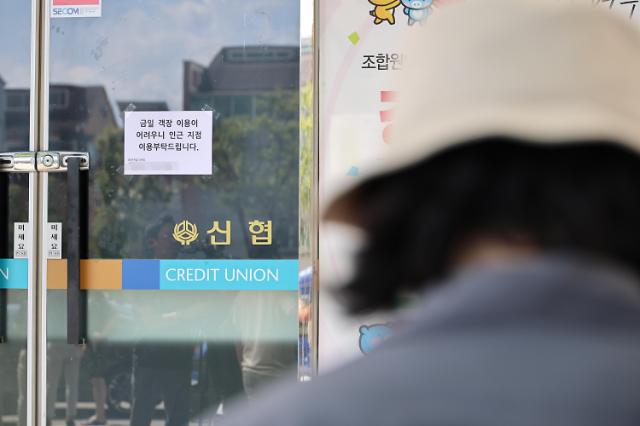

[Courtesy of the Bank of Korea]

South Korea's central bank kept its benchmark interest rate unchanged for the ninth straight month at 1.5 percent Thursday, as expected, but left open the possibility of cutting it as early as next month.

The Bank of Korea (BOK) has been under mounting pressure to cut rates as economic indicators showed little signs of Asia's fourth-largest economy rebounding. But it opted to monitor the outcome of policy meetings in advanced economies and global market conditions.

The European Central Bank's governing council meeting will take place on March 10, and the US Federal Reserve's Federal Open March Committee's meeting starts on March 15.

The BOK's monetary policy board said in a statement: "The domestic economy will continue its recovery going forward, centering around domestic demand activities, but in view of external economic conditions judge the uncertainties surrounding the growth path to be high."

The board will "closely monitor external risk factors such as any changes in the monetary policies of major countries or in financial and economic conditions in China, the movements of capital flows, geopolitical risks, and the trend of increase in household debt", the statement said.

Thursday's decision was not unanimous with one member voting for a rate cut.

Many analysts flag the chance of a rate cut in April as four of the central bank's monetary policy committee members are set to end their terms in late April and newly selected members will be cautious to move rates as soon as they take office.

But others see the BOK has no reason to move the rates anytime soon if the country's market environment shows signs of improvement, helped by rising oil and commodity prices.

During a post-meeting new conference, BOK Governor Lee Ju-yeol said capital outflows from South Korea has ceased in the middle of last month.

"When looking at capital flows this year, we saw many leaving South Korea until mid-February. Since then, we have seen inflows. I believe this was mainly due to risk-on sentiment from a rebound in oil prices and on policies by key economies to support growth," Lee said.

"Market rates have gone down after the four rate cuts made previously. However, we are unsure of the effect the rate cuts have had on exchange rates. Exchange rates can be affected by a number of reasons and this has made it difficult for us to track the effect of lower rates," he said.

Many analysts who saw a rate cut also said that recent turbulence in financial markets would have to abate before the bank would lower rates, citing the plunge of the won, which has been Asia's worst-performing currency because of "risk-off" sentiment. Some analysts said a rate cut could exacerbate that trend.

The won was traded at around 1,206 against the dollar at mid-day Thursday, nearly 0.81 percent up from Wednesday's close of 1,216.2.

"It is true that volatility in the dollar-won exchange rate has increased, but this just proves that the won is moving flexibly and in line with market movements," Lee said.

By Alex Lee