[Yonhap]

[This article was contributed by Robert Rhee, head of equity distribution at KB Securities in Seoul. It is the first weekly stock market article to be published in collaboration with KB Securities, one of leading brokerage houses in Korea.]

[Robert Rhee ]

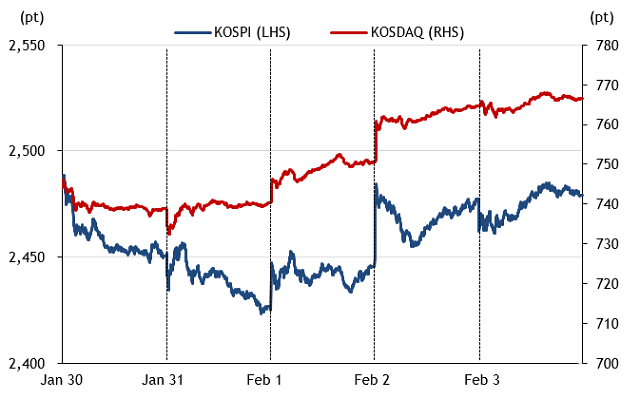

However, the market was able to end largely flat week-on-week closing at 2,480.40 supported by continued foreign net buying of 586.7 billion won ($468.9 million) (this year’s total net foreign buying stands at 7.7 trillion won). Marketing commentary persists of “peak inflation” possibly being reached as the January 31-February 1 Federal Open Market Committee (FOMC) meeting resulted in the Federal Funds Rate increasing by 25 basis points to a range of 4.5 percent to 4.75 percent.

Although Fed Chairman Jerome Powell warned that “ongoing” rate increases were still needed to bring inflation under control, he left the door open to the possibility of one final rate hike which was interpreted as dovish.

Moreover, U.S. tech earnings surprise contributed to the market rally. Meta surged by double digits after reporting better-than-expected earnings and positive commentary of pursing a leaner and more efficient management structure. CEO Mark Zuckerberg said, “We’re working on flattening our org structure and removing some layers of middle management to make decisions faster, as well as deploying AI tools to help our engineers to be more productive.”

[Graphic by KB Securities]

Wall Street awarded the results and positive comments with a slew of target price upgrades for Meta. The risk-on sentiment flowed over onto the Korean markets with overall tech and internet stocks outperforming. The tech heavy KOSDAQ, in particular, rallied to close 3.5 percent higher at 766.79 on February 3 from a week before.

By sector, highly cyclical sectors outperformed strongly week-on-week such as consumer electronics, semiconductor and shipbuilding all rallied by single to double digits. The worst performing sector was the banking sector which was negatively impacted from market commentary of peak inflation; thus possibly peaking net interest margins maybe experienced by banks as central banks may look to slow the pace of interest rate hikes.

The week ahead

This week, the KOSPI will continue to be influenced by company earnings results; however, the overall year-to-date (YTD) market uptrend could remain intact if foreign inflows continue to support the KOSPI. Foreign flow trends suggest this investor class is increasing their Korean market weighting from underweight to neutral levels. I expect this trend to continue.

On the macro front, the key data release to be cognizant of is the U.S. January jobs report which was released on February 3. The report showed 517,000 jobs were created in the U.S. in January and unemployment fell to 3.4 percent, its lowest rate in 54 years. This will likely impact all markets, let alone Korea, given the important read through on the direction of inflation.

Moreover, China’s consumer price index (CPI) and producer price index (PPI) and U.S. consumer sentiment data will be released on February 10. Depending on the agreements reached or comments provided, be watchful of any news about China supply chain easing that will also influence the all-important inflation discussion.

![[Weekly Stock Market] Overall foreign buying trend is likely to continue](https://image.ajunews.com/content/image/2023/02/26/20230226054630286939.jpg)

![[Weekly Stock Market] Markets to focus on macroeconomic data, Chinas reopening](https://image.ajunews.com/content/image/2023/02/12/20230212050855540410.jpg)